With 5 state elections and the farmer agitation fiasco the budget was expected to be populist and fiscally imprudent , The govt should have indexed slabs to real or at least CPI Inflation to give relief to people. ET says Middle class taxpayers left in lurch again as there are no changes in the tax front

Budget math doesnt add up .. it seldom does in India The combined deficit of States and centre is 10.5%+ .. and govt will go for record deficit financing ..This is interesting as US fed is expected to up Interest rates and change policy from ultra super easy monetary policy . THE RBI and Modi govt will depend on INFLATION TAX as a means to balance its books !!

Will we have runaway food inflation ??? Already real food inflation is massive ,, greens prices are double .. vegs costs are up 25to 50%

TAX Rates refresher

Standard deduction Rs 50,000 as provided, they opt for the old tax regime in the financial year 2022-23.

Broad Tax Proposals

- Provision for filing ‘Updated Income Tax returns’ within 2 years from end of relevant AY

- Reduced AMT rates for Co-operatives from 18.5% to 15%

- Reduced surcharge for Co-operatives with total income of 1cr to 10Cr Proposal will reduce surcharge on cooperative societies to 7%.

- Tax relief for persons with disability: Allow annuity payment to differently abled dependents when parents attaining age of 60 years

- Deduction for National Pension Scheme for State Government employees u.s 80CCC made at par with Central Govt.

- Start-ups established before 31.03.2023 (earlier – 31.03.2022; now extended by 1 year) will be provided tax breaks

- Last date for commencement of manufacturing for claiming lower tax regime under Section 115BAB to be 31.03.2024 (earlier 31.03.2023; now extended by 1 year)

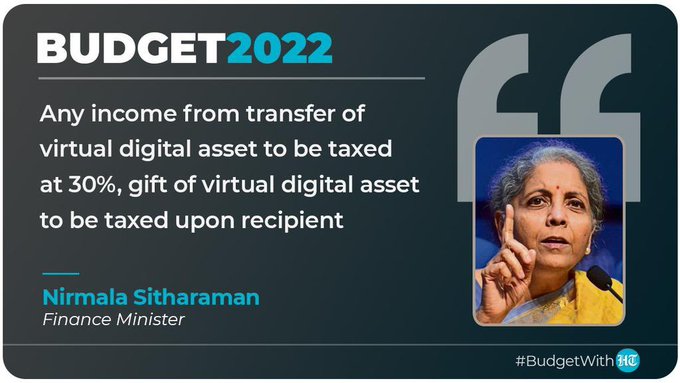

- Virtual digital assets (Cryptocurrency):

Income from transfer of virtual digital assets to be taxed at 30%; No deduction for expenses other than cost of acquisition; No set off of losses

TDS @ 1% on consideration above specific threshold

Gift to be taxed u.s 56(2)(x) - No repetitive appeals for common question of laws

- Off-shore banking units/ IFSC income to be provided exemptions

- Surcharge of certain AOPs to be capped at 15%

- Surcharge on Long Term Capital Gains on any assets to be capped at 15%

- Health and education cess not allowable as business expenditure u/s 37

- No set off of losses against undisclosed income detected during search

- Any cess or surcharge on income not allowed as business expenditure

- 1 per cent TDS on transfer of virtual assets above a threshold, gifts to be taxed

- Surcharge on long-term capital gains capped at 15 per cent

- Loss cannot be set off from any other income

Expenditure and deficit & other key numbers

Proposed fiscal deficit of 4.5% of GDP by 2025/26

Projected fiscal deficit of 6.4% of GDP in 2022/23

Revised fiscal deficit for 2021/22 at 6.9% of GDP

50 year interest free loans over and above normal borrowing allowed for states

Scheme for financial assistance to states for capital investment outlay to be Rs 1 lakh crore for 2022/23 Public issue of Life Insurance Corporation expected shortly

Tax payers can update returns within 2 yrs of AY: Taxpayers will be given more time to update their income tax returns (ITR), announced FM Nirmala Sitharaman during her Budget 2022 speech. As per the announcement, “I am proposing to file an updated return on payment of additional tax for two years from the end of the relevant assessment years.”

Budget 2022 levies 30% tax and TDS on crypto assets: The government has proposed that transfer of any virtual/cryptocurrency asset will be taxed at 30%. No deduction except cost of acquisition will be allowed and no loss in transaction will be allowed to be carried forward, the finance minister announced in Budget 2022 today. TDS will be imposed on payments for the transfer of crypto assets at a rate of 1% for transactions over a certain threshold. Gifts of crypto assets will be taxed in the recipient’s hands.

Some pointer from Economic times site